Prop 13 Reform: Back and Better Than Ever

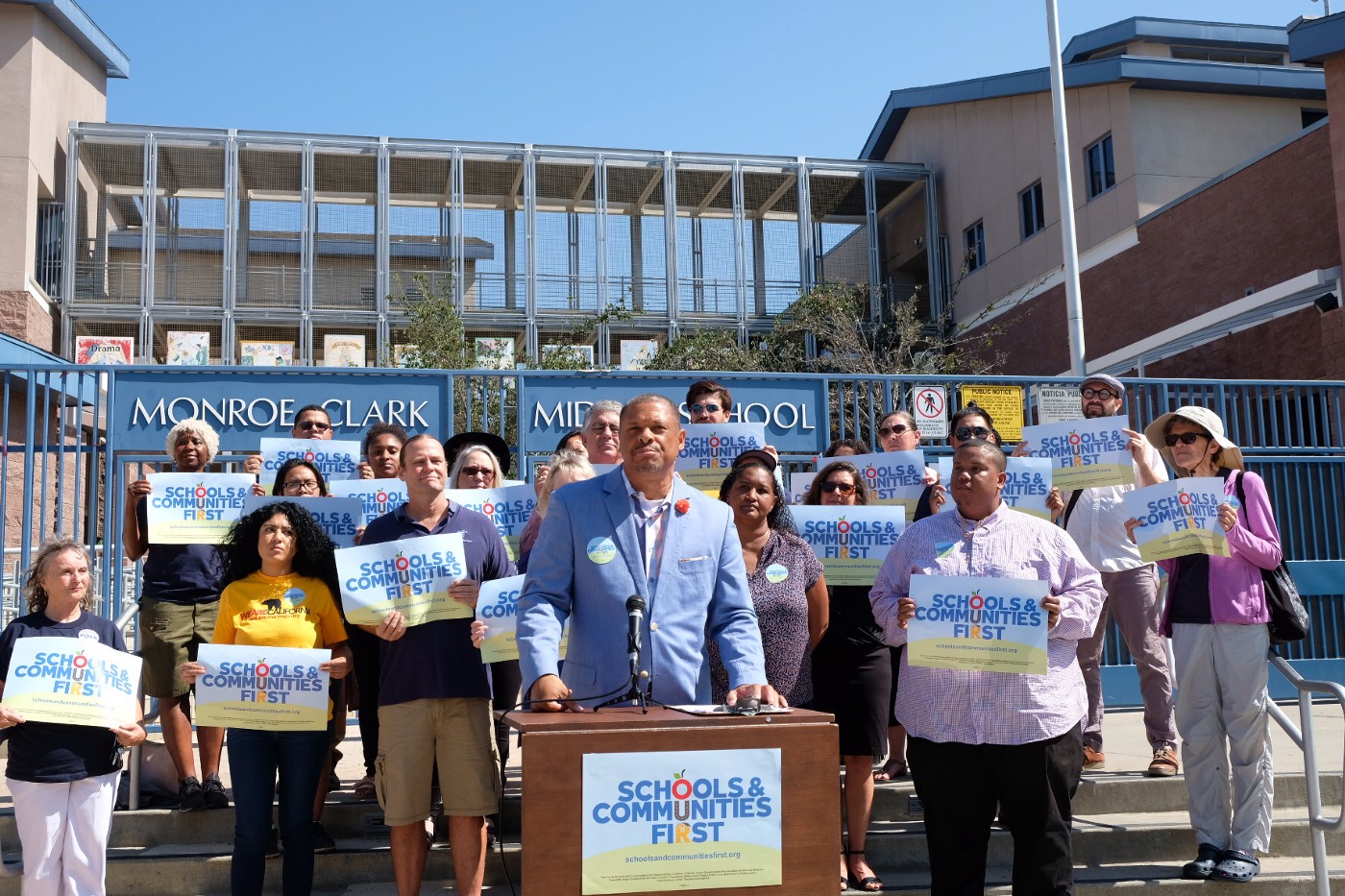

For the last two years, TechEquity has been a part of an unprecedented statewide coalition to reform a decades-old property tax law, Proposition 13.

We’ve written extensively about why Prop 13 is in need of reform. In short, the Schools and Communities Funding Act will close the corporate property tax loophole created by Prop 13 in 1978, restoring $12 billion per year to California’s budget.

That $12b, which amounts to about a billion dollars per year to San Francisco County, would provide desperately needed funds for public education and local services such as homelessness prevention, childcare for low-income families, and affordable housing. It would also create incentives for property owners to develop land that is currently underutilized, which would drive more housing and economic development.

I thought this measure already qualified for the ballot? What happened?

You’re absolutely right. A previous version of this measure did qualify for the ballot. Last year, advocates — including TechEquity — submitted thousands of signatures to qualify a version of the measure for the ballot.

So why are we doing this again?

We need to make changes to the measure. California’s political process has some idiosyncrasies. If you want to change one of the state’s laws that was passed via the ballot measure process (as Prop 13 was in 1978) you usually need to make those changes by passing another ballot measure.

Putting a measure in front of Californians for a vote is a finicky process: you must first write your language and submit it to the Attorney General, the Attorney General reviews the language, and they approve it for petition circulation.

When a voter signs the petition, they’re signing to say they want the language submitted to the Attorney General to appear before the voters, not something else. You can’t go back and change the language; you just have to start the process over again. California does this to preserve the integrity of the will of the people.

What did we need to change about the measure language?

During our work to qualify the 2018 version of the measure, we received feedback from an array of diverse voices. We’ve improved the bill’s language based on feedback from stakeholders around the state.

Our new language that we have refiled with the Attorney General this year significantly strengthens the measure. Revisions have allowed our coalition of supporters to grow and widens our path to victory in 2020. The revisions:

- Clarify that any property used for residential purposes, regardless of how it’s zoned, will be exempt.

- Expand small business relief to exempt properties valued at less than $3 million (previously $2 million), delay reassessment timeline for commercial properties with a majority occupancy of small businesses, and clarify the definition of a small business.

- Provide a personal property tax exemption to all small businesses.

- Expand the phase-in period for reassessment of property and provides revenue for the implementation of the measure.

- Ensure all school districts benefit from our reform. The new measure clarifies how revenue will be allocated to Basic Aid School Districts, typically found in wealthier communities.

- Make technical fixes to implementation dates.

You can see the full new language here.

Requalifying seems like a lot of work…is it worth it?

Absolutely! This is the greatest tax reform of our generation. It’s likely to be the most expensive ballot measure in California’s history, and one of the most consequential. Big business will be fighting hard to undermine our measure and scare voters. By making these changes, we’ll have a stronger measure that’s more resilient to attacks from our opposition.

We have to get this right. We’ve already begun to see the benefits of reworking our measure. The Attorney General has issued a new official summary of our measure is stronger than ever, which will bring thousands of voters to our side when they read their ballot.

Amazing! How can I help?

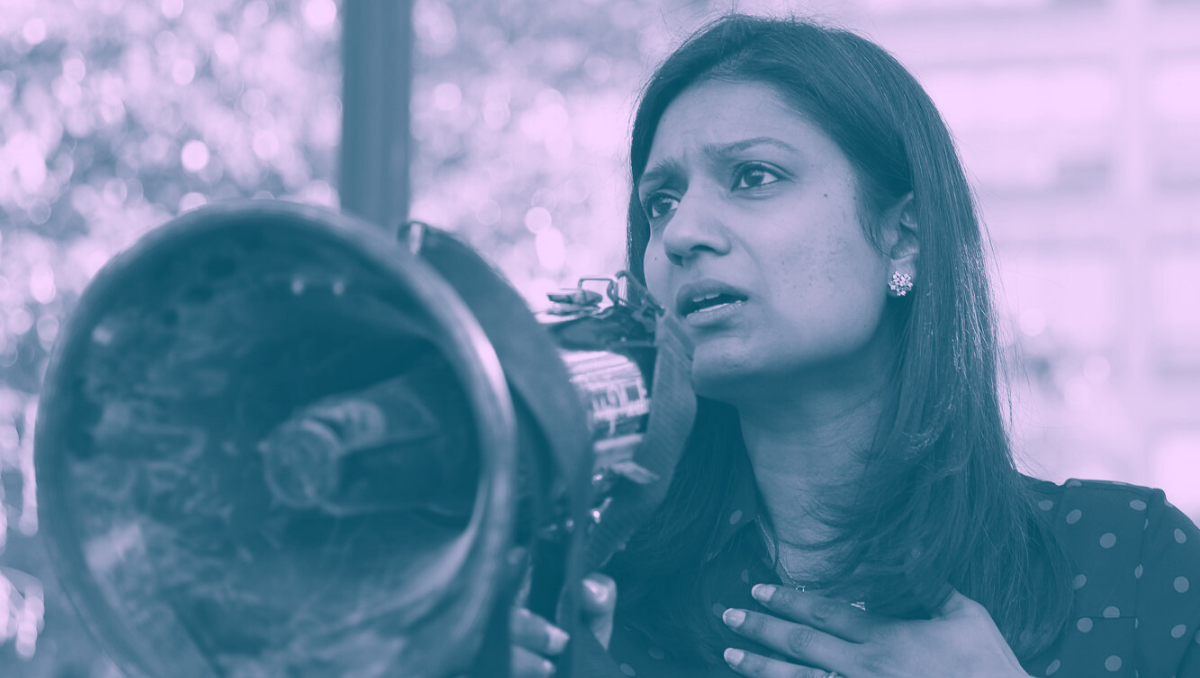

We’ll need an undeniable grassroots movement to qualify this historic reform for the ballot and ensure its passage. There are three things you can do to help:

- Spread the word! We need to make sure every voter is well informed about our measure. You can help our campaign win by simply talking to friends, family, and coworkers about the measure. Make sure you’re signed up with us to stay up to date.

- Gather signatures! We need to gather over a million signatures by March 2020 to qualify our reform for the ballot. If everyone who supports our reform gathers 5–10 signatures from friends and family, we’ll be in good shape. Come to our next event to get what you need to gather signatures.

- Donate! Corporations will be fighting tooth and nail to keep their sweetheart tax deal — our campaign needs resources to fight back! Chip in here.