Prop 15: What You Need to Know

Election Day is just around the corner. While the presidential race is drawing the most attention, ballot measures and candidates in local and state races have the potential to drastically reshape our communities, amidst and after the COVID-19 pandemic.

That’s why we’ve launched this blog series, to break down the key issues on the statewide and local ballots.

Check out our elections page for articles on the other statewide and local measures.

What is Proposition 15?

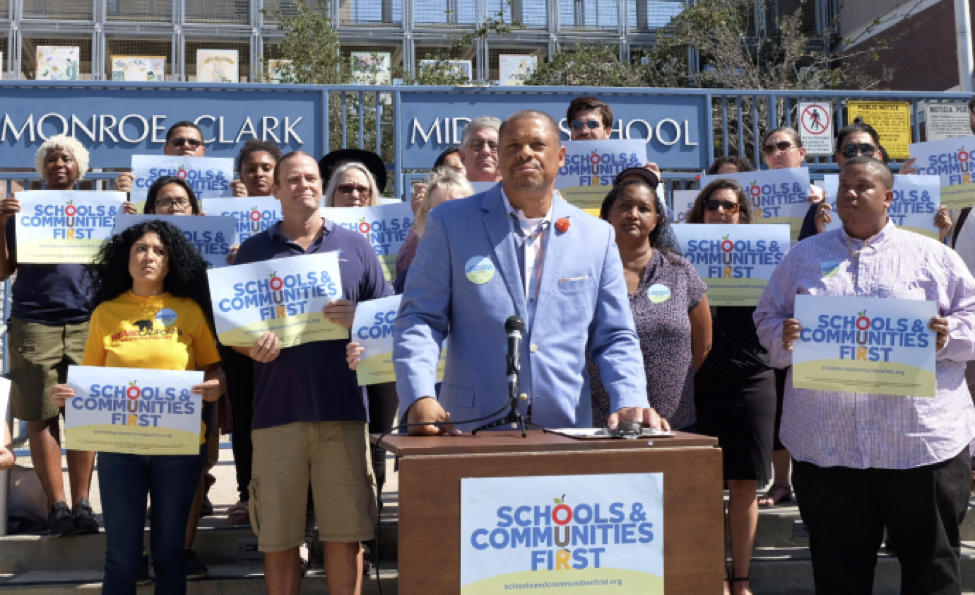

Proposition 15, put forth by the Schools and Communities First coalition, would raise up to $11.5 billion per year by closing a commercial property tax loophole that mainly benefits large corporate property-owners. The revenue raised by the measure would increase funding for public schools and community services.

60% of the funding raised by the measure would go to community services and the remaining 40% is reserved for public schools. K through 12 schools would receive 89% of the education funding, with the remaining 11% going to community colleges. Currently, commercial property owners receive the same property tax break as California homeowners. For both, the value of the property for tax purposes is not tied to its current market value. Proposition 13, passed in 1979, instead limits the assessed value to the purchase price plus at most 2% annual appreciation for tax purposes. This means that the assessed value is usually much lower than the market value, which dramatically reduces the property tax revenue available to local governments.

Proposition 15 would eliminate this tax break for commercial property owners starting in 2022. It would instead assess their property taxes based on current market value, like most other states. Residential properties, as well as agricultural properties and commercial properties worth less than $3 million, would not see any change in their property taxes.

Proposition 15 doesn’t dictate how the community services funding can be used, rather local governments are empowered to decide how to put the funding to its best use. If the measure had specified uses for this portion of the funding, a two-thirds majority would have been required to pass it. Since the use of the revenue is not restricted, the measure only needs a 50% plus 1 vote majority to pass.

Why does it matter?

Proposition 15 finally addresses a root cause plaguing many policy issues in California. The massive tax break for commercial landowners robs California cities and counties of $11.5 billion every year. The budget hole created by that giveaway puts an enormous strain on funding for education, affordable housing, health care, and many other important services in our communities. It also distorts the way land is used in California by allowing owners to sit on property as an investment asset and forces state and local governments to tap other revenue sources—which come with harmful side effects.

The economic decline resulting from the COVID-19 pandemic has opened a $54 billion hole in the state’s budget and a $23 billion shortfall in local government budgets. Diverting money that could be used to hire more teachers, build more affordable housing, or bolster our wildfire protections was always a poor policy decision, but the budget crisis caused by the pandemic makes it absolutely clear that we can no longer afford to give wealthy commercial landowners a massive tax break.

It is important to note that activity around Proposition 15 will not end after the election. Since the measure does not specify how the community services funding will be allocated, local governments will need to decide how to spend the increased property tax revenue. There are important equity issues wrapped up in those spending decisions. Advocates for marginalized communities will continue to fight to make sure that the funding is used on programs that lift up their community members, and we recognize that this will continue to be an important issue in the years to come.

Who supports Proposition 15 and what’s their argument?

Supporters of Proposition 15 argue that the measure will raise $11.5 billion annually that will be used for schools and community services including building affordable housing, addressing the homelessness crisis, and providing health care. They also argue that the measure will steer commercial property owners towards more productive uses for their land and mitigate some of the inequities of tax policies that local governments have had to use to fill the gap in property tax revenue.

Reclaiming $11.5 billion dollars each year will help California restore funding for its public schools, which once ranked 7th in the nation in funding per student but have fallen to 29th in recent years. These additional tax dollars will also help alleviate the housing crisis. Proposition 15 will provide a long-needed sustainable funding source that local governments can use to build affordable housing. The money can also be used as a steady source of funding for services that support and house those affected by California’s homelessness crisis.

Proposition 15 will also help address the housing crisis by shifting the incentives in California’s land use policy to more productive uses, like housing. Under the current system where commercial property owners pay substantially discounted taxes, owners can sit on their property and wait for the value to rise before selling.

By taxing the property at its market value, owners will be forced to develop the property in a more economically productive manner so they can pay the higher tax bill. This means that idle land (for example, land used as a parking lot) will be more likely to be turned into better uses, such as housing. Since California needs to build 3.5 million homes to get out of the current crisis, we need to take bold steps like passing Proposition 15 to ensure that our state’s natural resources are put to better use like housing people instead of serving as a speculative asset.

The tax break for commercial property owners starves local governments of revenue and forces them to use alternative funding methods that place more of the tax burden on low-income residents. Sales tax increases, parcel taxes, and fees are common sources of local government revenue and they are all more burdensome for low-income residents. Low-income households spend a larger portion of their income on things subject to the sales tax, which means that sales tax makes up a larger portion of their income than for wealthier families. Parcel taxes and fees are usually flat assessments that don’t change with the value of one’s property or the income of the payer. This also means that lower-income families pay a larger share of their income on these taxes and fees than higher-income households. Passing Proposition 15 and requiring commercial property owners to pay their fair share in taxes will allow local governments to reduce their reliance on these regressive taxes and fees and give lower-income residents a more deserved tax break.

The campaign to pass Proposition 15 is led by the Schools and Communities First coalition (TechEquity is a member of Schools and Communities First). Its supporters include many housing, labor, and community organizations like ACCE, California YIMBY, the California Labor Federation, and the California Teachers Association. Many of the state’s elected officials have also endorsed Proposition 15 including the mayors of San Francisco, Oakland, Berkeley, and Los Angeles; State Senators Nancy Skinner, Scott Wiener, and Bob Wieckowski; and State Assemblymembers Rob Bonta, Buffy Wicks, David Chiu, Kevin Mullin, Ash Kalra, Kansen Chu, and Bill Quirk.

As of publication, supporters have raised about $30 million and the top 3 funders in support of Proposition 15 are the California Teachers Association, SEIU, and the Chan Zuckerberg Initiative (TechEquity also receives funding from the Chan Zuckerberg Initiative). The latest contribution data can be found here.

Who opposes Proposition 15 and what’s their argument?

Opponents of Proposition 15 argue that the measure will raise taxes on commercial property owners who will then pass on those increases to their tenants and consumers, potentially harming small businesses. Opponents also argue that the measure will be hard to implement and could open the door to reducing or eliminating property tax breaks for homeowners.

Opposition to Proposition 15 is led by the No on Prop 15 Committee, a coalition of commercial property owners and business groups, and Protect Prop. 13 which is sponsored by the Howard Jarvis Taxpayers Association.

As of publication, opponents have raised about $11 million and the top 3 funders in opposition to Proposition 15 are the California Businesses Roundtable, the California Taxpayers Association (a PAC with substantial contributions from the Union Pacific Railroad), and the California Farm Bureau Federation. The latest contribution data can be found here.

TechEquity Votes YES on Proposition 15

TechEquity has been a longtime supporter and member of the Schools and Communities First coalition and we are proud to now endorse Proposition 15. It’s imperative that we reclaim the $11.5 billion we give away every year to commercial property owners. That money will help our cities and counties weather the economic downturn from the pandemic, boost school funding, build affordable housing, provide homes and services for our unhoused neighbors, and improve a long list of other community services. Ending the commercial tax break will encourage housing production by removing incentives for property owners to sit on their land and will also wean local governments off regressive taxes that unfairly burden lower-income residents.We say vote YES on Proposition 15!