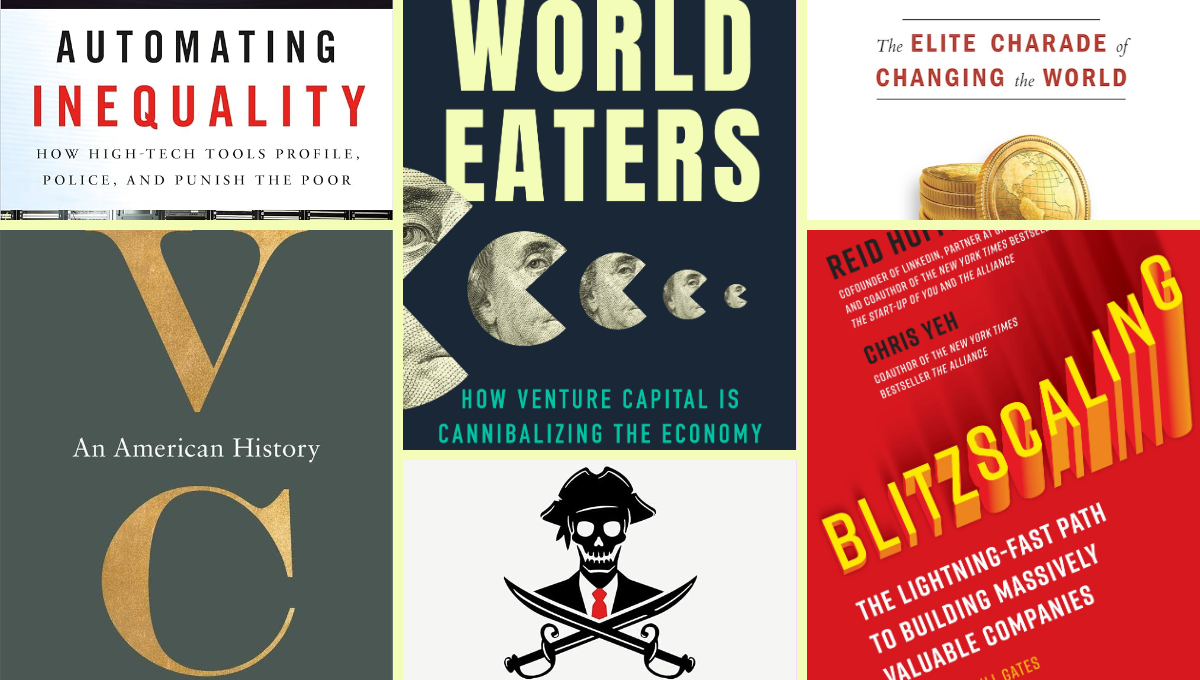

World Eaters – In a nutshell

The modern tech-driven economy is not working for most of us—so what can we do about it?

If we are going to solve the challenges that the tech industry has created, we need to address its problems at its root.

TechEquity’s research found that venture capital is impacting the health of our economy by exacerbating the housing crisis, exploiting workers, and suppressing innovation in the areas where we need it most. In order to sufficiently address tech’s inequities, simply put: we need to follow the money.

That’s why TechEquity Founder and CEO Catherine Bracy spent the past three years researching venture capital and writing World Eaters: How Venture Capital is Canabilizing the Economy. These are our top takeaways from the book.

1. Tech isn’t the problem. Venture capital is.

Venture capital originated as funding for high-risk, early-stage ventures that could produce groundbreaking technology—and the dividends that come with it.

Instead, venture capital became a bloated industry. Instead of investing in truly breakthrough technologies—that, yes, could get them rich, but also benefit us all— it’s become a sector obsessed with raking in short-term results and exponential growth at any cost.

There’s no pause button. Companies either scale up or die out.

Why would venture capitalists take this approach, even though most companies die out because of it? It’s because they’re operating under the power law: firms only need a small number of successful investments to generate the vast majority of returns. Initially, the power law was an observed phenomenon of investing in new technology. But many venture capitalists today are just trying to reverse-engineer the successes of the past in the quest for riches.

In their own quest to acquire VC funds, startups are forced to tell a story about venture-scale growth—whether it is true or not. Then they are pushed by investors to take the profit-maximizing path at every turn in order to scale as fast as possible. That often means cutting regulatory corners, exploiting workers and customers, and pushing unnecessary risk on society.

2. The state of labor can be traced back to VC.

The inevitable result of these practices is an unjust economy—i.e. the economy we live in today.

Venture capital-backed business models have been upending decades of critical labor protections provided through the New Deal policies (from the 1930s) that built the American middle class. The New Deal created a bargain between employers and workers that, in exchange for workers powering the growth of industry, employers would be liable for ensuring workers’ rights—like an 8-hour workday.

In search of exponential growth and large returns, tech companies are increasingly finding ways to classify workers vital to their growth as contractors who they aren’t liable for—a violation of the New Deal spirit.

They’re contracting out their work through third-party agencies in the US and abroad. These workers are typically paid less and work under worse conditions than your average tech worker.

Meanwhile, companies like rideshare platforms bring gig workers onto their platforms with the promise of decent wages and flexible work, only to turn on these workers, decreasing wages once they cornered the market.

3. VC is funding the downfall of the American Dream.

Market size is key to venture capital, and there is no bigger (and consequential) opportunity than the $45 trillion American residential real estate market.

Discrimination in the housing market also has and continues to widen the prosperity gap between white Americans and everyone else, especially Black Americans.

Property tech (aka Proptech) has automated and, in some cases, exacerbated these inequities. Venture-backed companies are incentivized to put things out on the market as soon as possible, whether or not the product has potential adverse impacts—including denying people access to housing based on biased tenant-screening tools.

In the cases of alternative home financing and rent-setting software, they can even be incentivized to participate in or enable predatory practices.

4. The real problem isn’t the companies that VC funds—it’s the ones it doesn’t.

If you’re an entrepreneur with a great idea who doesn’t want to scale up fast—and potentially break society, the economy, and our political system—you are usually faced with two options:

- Take VC money and distort your business to chase growth you can’t sustain.

- Get no funding at all.

The result? VC doesn’t just fund bad businesses. It crowds out the good ones, siphoning capital away from sustainable solutions and into the next speculative bubble.

But change is possible. We can build a startup ecosystem that rewards real value, not just speculative hype. And if we get it right, we won’t just fix tech—we’ll fix the economy.

Check out World Eaters: How Venture Capital is Canabilizing the Economy to learn more.