November 2020 Voter Guide – San Francisco

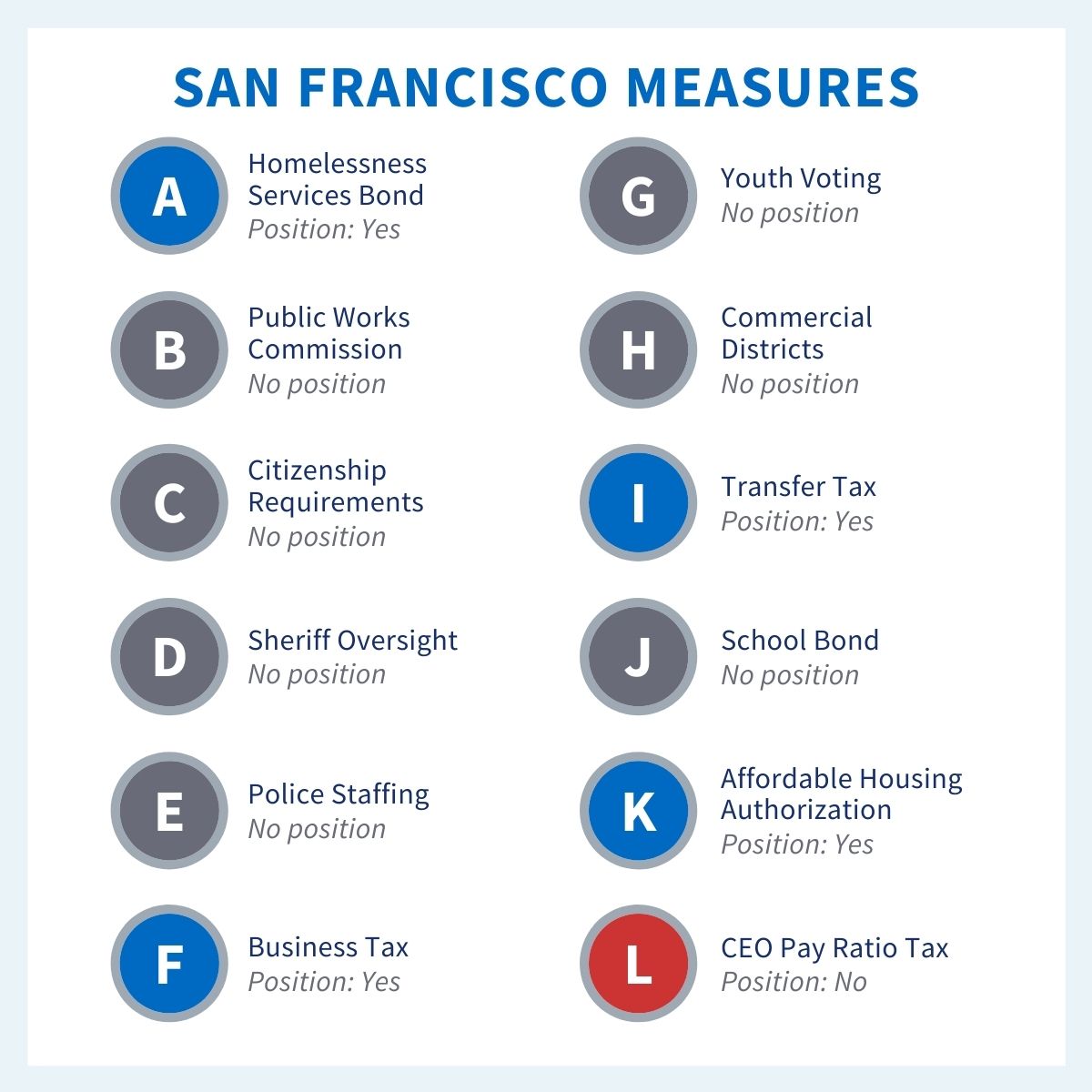

In California, policy change often happens on the ballot, and many of the ballot initiatives—especially the local ones—can be hard to understand. Our team has evaluated each of twelve local measures in San Francisco to provide clarity on what the measures do and, where they intersect with TechEquity’s advocacy platforms, make recommendations on how our community should vote. Measures that require a supermajority to pass are denoted with an asterisk (*).

San Francisco would borrow $487.5 million to use for housing and services for unhoused San Franciscans, parks, and street and sidewalk maintenance and improvements.

What is Proposition A?

Prop A would allow San Francisco to borrow $487.5 million by issuing bonds and paying the money back with interest over 30 years. $207 million of the borrowed money would be used on supportive housing and shelters, as well as facilities and services for those with mental health and substance use issues. This money would help offset limited state and federal funding as well as the high cost of construction in the city. $239 million would be used for maintenance of parks, open spaces, and recreation facilities which currently have a $950 million deferred maintenance shortfall. The remaining $41.5 million would be used to repair roads and sidewalks, install curb ramps, and make seismic upgrades to public plazas and structures. Currently, there is $799 million in deferred maintenance for roads and public facilities.

Position: Yes. Housing and supportive services for unhoused San Franciscans continue to be extremely pressing needs. The homelessness crisis was already a top priority for the city and the pandemic has only worsened the crisis. The city is correct to seek additional funding, especially considering the limited support from the state and federal government. As always when evaluating bonds for important programs, we recognize that there is a serious need for sustainable funding sources to support these services. That’s why we are longtime supporters of statewide Proposition 15, which would reclaim funding for these important community services. Even if Prop 15 passes, it will still be a few years until the new revenue reaches San Francisco, so we support using this bond to fill in the gap in the meantime.

Street cleaning, sidewalk maintenance, and sanitation would be taken away from the Public Works department and a new department would be created for these responsibilities.

What is Proposition B?

Prop B would take street cleaning, sidewalk maintenance, and sanitation duties away from the Department of Public Works (DPW). The city would create a new department to perform these tasks. It would also create an oversight commission for the new department and DPW. This measure follows a major fraud scandal involving the former head of DPW, Mohammed Nuru.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Non-citizens would be allowed to serve on city advisory boards.

What is Proposition C?

Prop C would remove the restriction that requires advisory board members to be U.S. citizens. This means non-citizens would be able to serve on boards who give advice to city and county government bodies. The measure would also make all references to committee members gender-neutral.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

The San Francisco Sheriff’s Department would be subject to greater oversight.

What is Proposition D?

Prop D would create an oversight board that can make policy recommendations to the sheriff’s department and the Board of Supervisors. It would also create an Office of Inspector General within the department to investigate complaints and in-custody deaths. Neither the oversight board nor Office of Inspector General could discipline department employees, but they both would have subpoena powers to conduct investigations. The measure would also require any evidence of criminal misconduct by department employees to be sent to the San Francisco District Attorney’s office.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

The City Charter requirement that the San Francisco Police Department has a minimum of 1,971 police officers would be eliminated.

What is Proposition E?

San Francisco’s City Charter requires SFPD to have at least 1,971 full police officers on staff. Prop E would replace that minimum officer requirement with a mandate to issue a staffing report to the Police Commission every two years. This would make it possible to reduce the number of officers in the department.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

An adjustment to the gross receipts tax that would cut taxes for small businesses but overall bring in more revenue than the current business tax.

What is Proposition F?

Prop F would overhaul the way San Francisco taxes businesses. The measure would lower taxes for small businesses while raising them for medium and large businesses. Overall, Prop F would bring in an additional $97 million annually, which would help fill the large budget deficit caused by the pandemic. The new tax rates would phase in from 2021 to 2024 and businesses who have been hurt by the pandemic will get more time before any higher taxes would kick in. The measure also provides guaranteed funding for the early childhood education program created in a 2018 ballot measure, which has had its original funding source challenged in lawsuits.

Position: Yes. San Francisco faces a serious budget deficit because of the recession caused by the pandemic. It also has a business tax that is in need of some tweaks to make it work better and fairer. Prop F helps with both of these problems. The changes it makes to the business tax will bring in an additional $97 million per year. This is not enough to close the budget gap, but every bit helps. The measure also makes the business tax fairer by shifting the tax burden towards larger businesses that can more easily handle the higher rates. Additionally, it finally gets rid of the city payroll tax, which, because it taxes worker salaries, has a negative effect on jobs in the city. Getting rid of that hindrance to hiring is another small but positive effect of Prop F on San Francisco’s economic recovery. Prop F manages to raise money, make the business tax fairer, and remove an obstacle to adding jobs, and so we think it deserves a yes vote.

16 and 17 year-olds would be allowed to vote in San Francisco elections.

What is Proposition G?

Prop G would allow 16 and 17 year-olds to vote in local elections. They would still be ineligible to vote in state or federal elections.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Obtaining permits for a new retail store in certain areas of the city would be faster and easier.

What is Proposition H?

Getting the proper permits to open a new retail store is notoriously difficult in San Francisco and contributes to the high retail vacancy rate. Prop H would streamline the process by requiring city agencies to issue the permits within 30 days. The streamlining would only apply to new stores, cafes, and restaurants that comply with existing zoning requirements and are located in neighborhood commercial districts.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

An increase of the tax paid when real estate worth $10 million or more is sold, with the proceeds promised to fund pandemic eviction relief and affordable housing.

What is Proposition I?

San Francisco charges a tax when a commercial or residential property is sold. Prop I would increase the tax rate from 2.75% to 5.75% for properties worth $10-$25 million and from 3% to 6% for properties worth more than $25 million. The Board of Supervisors passed a non-binding resolution to use the revenue raised by the measure for rent assistance to reduce evictions caused by the pandemic and to fund a program that would create publicly owned affordable housing. From 2022 onward, all the extra tax revenue would go to the affordable housing fund.

Position: Yes. This one was a tough decision. We’ve been consistent supporters of transfer taxes as multiple cities around the Bay, including Oakland, Berkeley, and San Jose, have enacted them in recent years. We also support Prop I money going to eviction prevention and affordable housing. At the same time, Prop I uses a different approach to raising the transfer tax than those other cities, and unfortunately, it spares wealthy homeowners and puts more of a burden on apartment construction. The threshold for higher transfer taxes in those three cities is set around $1.5-$2 million and the increases in the tax rates were smaller than proposed in Prop I. This matters because a threshold around $2 million would capture a substantial amount of sales by wealthy homeowners; however, since the tax rate increase is relatively small, it would have less of an effect on apartment production. San Francisco largely exempts wealthy homeowners and puts more of a burden on commercial properties, including apartments. Overall, we feel that the need for funding to prevent pandemic-related evictions and build affordable housing outweighs the poor design of Prop I’s transfer tax, so we recommend a yes vote.

A $288 tax on each property in San Francisco to fund public school teachers’ salaries.

What is Proposition J?

Prop J would ensure proper funding for San Francisco Unified School District (SFUSD) teachers by imposing a $288 parcel tax on each property in the city. A similar measure passed in 2018 with a majority vote, but that measure has been tied up in lawsuits over the proper majority threshold. Prop J uses a two-thirds majority which would guarantee the funding even if the old measure is struck down by the courts.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Approves 10,000 new units of affordable housing in San Francisco, but doesn’t fund the housing.

What is Proposition K?

Under Article 34 of the California Constitution, local voters must authorize new affordable housing. Prop K would grant permission for 10,000 new affordable units. The measure would not raise funding for those units or approve any specific projects to build the units, it would only satisfy the Article 34 requirement.

Position: Yes. We support building more affordable housing in San Francisco. It’s frustrating that this has to go on the ballot because of the racist, exclusionary Article 34. We recommend a yes vote on Prop K and commend State Senator Scott Wiener for his efforts to repeal Article 34. We hope to never see this topic on a ballot again.

An additional tax on companies whose top executive is paid at least 100 times as much as their typical San Francisco employee.

What is Proposition L?

Prop L would impose an additional gross receipts tax on companies whose top managerial employee (for example, the CEO) is paid at least 100 times more than the median salary of the company’s San Francisco employees. The measure would count all forms of compensation as pay for the purposes of calculating the pay ratio, including stock options and other equity compensation. A company with a pay ratio of 100 to 1 (ie. the CEO makes 100 times more than the median employee) would face an additional 0.1% gross receipts tax. The tax would get larger as the pay ratio grows with companies whose CEO earns 600 times the median San Francisco employee, paying an additional 0.6% gross receipts tax. The tax revenue would be highly volatile year to year, but is expected to bring in about $60-$140 million annually. The revenue from the tax would not be earmarked for a specific use.

Position: No. This is another tricky decision. Income inequality is one of the fundamental problems that we are trying to address with our work at TechEquity, so a tax on companies with high internal inequality is appealing to us. We are opposed to Prop L not because we disagree with the principle behind the tax, but because we take issue with some of the particulars of the measure. Calculating executive pay is difficult because it is heavily based on equity compensation, which is difficult to value. Prop L offloads calculating the pay ratio to the companies themselves and we have concerns that it will be accurately determined. We are also concerned that by only looking at the pay of San Francisco employees, the measure may give companies a reason to move low- and medium-pay jobs out of the city. This would be less of an issue if a larger jurisdiction, like the state, enacted this tax. The high volatility of the tax would make it hard for San Francisco to effectively plan how to spend the revenue. All of this adds up to the point where we think that however worthy the concept behind the measure, the flaws lead us to recommend a no vote on Prop L.