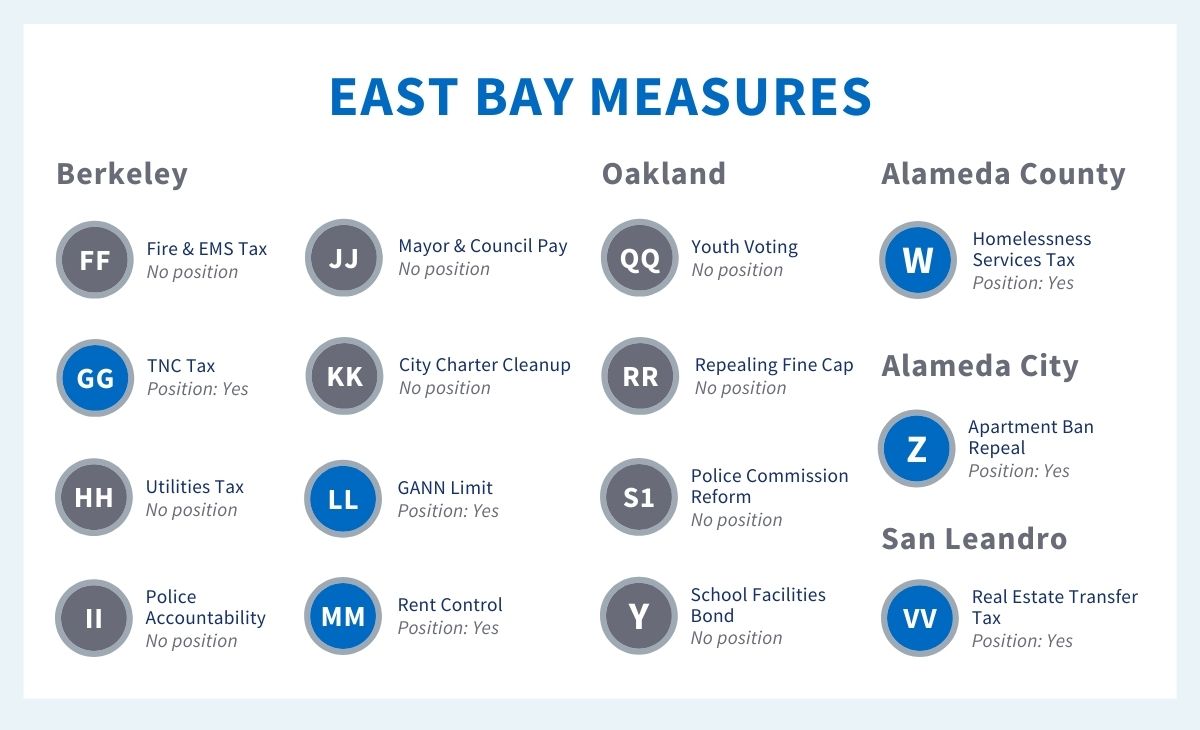

November 2020 Voter Guide – East Bay

In California, policy change often happens on the ballot, and many of the ballot initiatives—especially the local ones—can be hard to understand. Our team has evaluated the local measures in East Bay to provide clarity on what the measures do and, where they intersect with TechEquity’s advocacy platforms, make recommendations on how our community should vote. Measures that require a supermajority to pass are denoted with an asterisk (*).

The Oakland City Council would be authorized to pass a law allowing 16 and 17-year-olds to vote for the School Board Director.

What is Proposition QQ?

Prop QQ would open the door for 16 and 17-year-olds to vote for their School Board Director. The process is a little bit complicated, however. The measure would authorize the Oakland City Council to pass a law that allows the 16 and 17-year-olds to vote. Prop QQ itself wouldn’t grant those voting rights, but because the City Council placed the measure on the ballot it’s very likely they would follow through with approving the voting expansion.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

The City Charter cap on fines for ordinance violations of $1,000 would be eliminated and the City Council would determine a new limit.

What is Proposition RR?

Oakland’s City Charter limits fines for ordinance or code violations to $1,000. Prop RR would remove this cap and instead the City Council would hold a public hearing to determine a new cap. The current cap has been in place since 1968 and has not been adjusted for inflation.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

An independent Office of Inspector General to investigate police misconduct would be created, the Police Commission would gain additional powers, and the commission investigating complaints against police officers would gain greater independence.

What is Proposition S1?

In 2016, Oakland voters created the Police Commission to provide oversight of the Oakland Police Department (OPD) and they also created the Community Police Review Agency to investigate police misconduct complaints. Prop S1 would give both bodies more independence from both OPD and city government. Both the Police Commission and Community Policy Review Agency would be able to hire outside lawyers to assist their work. Currently, the Oakland City Attorney selects lawyers for both bodies. The measure would also require the Police Chief to respond to requests for information from the Police Commission and require the Community Policy Review Agency to complete its investigations within 250 days of the complaint. Prop S1 would create an Office of Inspector General outside of OPD to investigate the department and audit its compliance with court orders from the Riders case. The Police Commission would hire the Inspector General and have the right to fire the Inspector General if they have cause.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Oakland Unified School District would borrow $735 million to fund maintenance, repair, and upgrades to school facilities.

What is Proposition Y?

Prop Y would allow Oakland Unified School District (OUSD) to borrow $735 million and pay it back over 30 years with interest. The funds would go to maintenance, repair, and updates for school buildings. OUSD reports that it has a $3.4 billion need for work on its facilities. This bond would only cover a portion of that need, but, by law, is the most that OUSD can borrow through a bond measure. Some of the specific uses of the money include building new classrooms and kitchens, converting an unused school into an administrative building, and making very needed repairs to bathrooms. The bond payments will be paid for with an additional 0.05-0.06% property tax assessment.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

A property tax increase to raise $8.5 million annually for firefighters, emergency services, and wildfire prevention.

What is Proposition FF?

Prop FF would use a property tax increase to raise funds for fire and other emergency services. City staff report that costs for emergency services have risen in recent years, which necessitates the tax increase that should bring in $8.5 million annually. The additional funding would be used on firefighters, emergency medical services, the 911 system, and wildfire prevention. Property taxes would go up by 10 cents per square foot, so for example, taxes on a 1,900 square foot home would increase by $190 per year.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

A $0.50 tax on Uber and Lyft rides to fund general city services.

What is Proposition GG?

Prop GG would impose a 50 cent tax on solo Uber and Lyft rides or a 25 cent tax on shared rides. The tax would bring in about $910,000 annually, which would go into Berkeley’s general revenue fund. Only rides beginning in Berkeley would be taxed; rides in wheelchair accessible vehicles and rides paid for by public health insurance would be exempt. The tax would sunset in 20 years.

Position: Yes. Last year San Francisco passed a tax on Uber and Lyft rides which we supported and we support Berkeley’s tax for the same reasons. While the services have proved more convenient and less expensive than taxis, they have also come with a number of costs for society as a whole. The ride-hailing companies have been linked to a decline in public transit use, which is a problem when a significant portion of public transportation costs are paid for with fare revenue. These declines in ridership mean less revenue for the agencies and service cutbacks that hit low-income riders the hardest. Ride-hailing has also caused a large increase in traffic and vehicle emissions which we all pay for in longer travel times and greater climate damage. We support Prop GG because it is a small step in making users of these services cover the public costs of their rides and should provide a small push toward other transportation options.

A tax increase on electricity and gas to fund climate and environmental equity efforts.

What is Proposition HH?

Prop HH would replace the current 7.5% utilities tax with a 10% tax that has exemptions for low-income households. The measure is expected to raise $2.4 million per year, which likely will be spent on programs to increase climate and environmental equity. Berkeley’s city council, however, does have the right to use the tax revenue for other purposes.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

A new Police Accountability Board that has the ability to recommend discipline against officers and more investigative power than the current Police Review Commission.

What is Proposition II?

Prop II would replace Berkeley’s Police Review Commission which investigates complaints against city police officers. In its place, the measure would create a new Police Accountability Board with greater powers than the commission it replaces. The new board would also investigate complaints against officers but it will also make recommendations about police department operations and budget, have subpoena power for its investigations, review agreements between Berkeley police and other police agencies, and play a role in hiring the police chief.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

The Mayor’s salary would be increased to the area median income for a family of three and the City Council members’ pay would also be increased proportionally.

What is Proposition JJ?

Currently, the Berkeley mayor makes $61,304 and city council members are paid $38,695, both of which are based on salaries set in 1998 and subsequently adjusted for inflation. Prop JJ would increase pay for the mayor and city council members, using area median income (AMI) as a benchmark. This means that under Prop JJ the mayor’s salary would be $107,300 and city council members would be paid $67,599. If city employees are forced to take a pay cut because of city budget issues, the mayor and city council members would also see their pay reduced.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Four tweaks to the City Charter including removing citizenship requirements to serve on the redistricting commission and making the City Charter gender-neutral.

What is Proposition KK?

Prop KK is a set of four changes to Berkeley’s city charter. The redistricting commission would be renamed the Independent Redistricting Commission and non-U.S. citizens would be allowed to serve. All gender references in the City Charter would be made gender-neutral. The City Attorney would be appointed to an indefinite term and could only be fired with a vote of five City Council members. Berkeley firefighters would no longer have to live within 40 miles of the city.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Berkeley would be allowed to spend already collected additional revenue from special taxes like the recent real estate transfer tax increase.

What is Proposition LL?

Prop LL allows Berkeley to spend tax revenue it has already collected. California law caps the growth of city budgets. This policy, known as the Gann limit, requires voters to approve budgets that exceed the cap. In recent years, Berkeley voters enacted special taxes, including a real estate transfer tax, which push the city’s revenue over the Gann limit. Voters must approve this measure to allow the city to spend that tax revenue.

Position: Yes. Berkeley voters have already approved these taxes so the city should be able to spend the money. We supporters of real estate transfer taxes, because they are a progressive way for a city to raise money and recapture some of the value from land appreciation. Berkeley should be able to spend that money.

The pandemic eviction ban would become permanent, rent control exempt units would have to comply with the rental registry, and properties with multiple ADUs would be subject to rent control.

What is Proposition MM?

Prop MM makes three changes to Berkeley’s rent control law. First, it writes the city’s pandemic eviction ban into the rent control law, ensuring that tenants can never be evicted for missing rent during the pandemic. It also requires buildings that are exempt from rent control to complete the city’s rental registry and pay registration fees. Finally, the measure brings the rent control law’s treatment of ADUs in line with recent changes in state law. Now that state law allows multiple ADUs on a property, Prop MM clarifies that ADUs are exempt from rent control only if there is one ADU on the property.

Position: Yes. We are strong supporters of protecting renters from losing their homes due to the economic slowdown from the pandemic. We also have, twice now, sponsored a statewide rental registry bill and are excited to see Berkeley expanding their registry to cover almost all rental units in the city. These two provisions make it easy for us to recommend voting yes on Prop MM.

Repeals Alameda’s ban on building apartments and also removes a restrictive housing density limit.

What is Proposition Z?

In 1973, Alameda voters passed a measure that blocked the construction of multi-family housing in the city. Subsequent amendments have allowed for a very limited amount of new apartment construction. Prop Z would repeal that 1973 measure and open up Alameda for much more housing production. Prop Z would also get rid of a limit on housing density in the city that makes it a challenge to build multi-family housing in the few areas currently allowed in Alameda. This means that the new projects made possible by repealing the ban would be more viable and more likely to actually get built.

Position: YES. We are strong supporters of eliminating the racist, exclusionary barriers put up to prevent housing construction. These hurdles limit the supply of housing which makes homes more expensive. This combined with racial income and wealth gaps put homes in these communities out of the reach of many people of color, which is a major reason why residential segregation has remained pervasive. Prop Z is an important step in the larger fight to get rid of these insidious policies and should open Alameda up to a much wider and diverse group of families.

$150 million in additional funding to provide services for unhoused people in Alameda County.

What is Proposition W?

Prop W would raise $150 million annually to pay for housing assistance, mental health resources, and job training for unhoused people who live in Alameda County. The funding would come from a 0.5 cent sales tax increase for the next ten years. The number of people who are unhoused has increased during the pandemic while public budgets have gone deep into the red. This, according to the measure’s sponsors, necessitates the additional infusion of funding. To put the $150 million in perspective, Alameda County’s three-year action plan to address the homelessness crisis has a budget of $340 million.

Position: Yes. There’s no doubt that the pandemic has worsened the homelessness crisis while simultaneously limiting local governments’ ability to respond. This makes finding additional sources of funding to support some of the most vulnerable members of our community a necessity. Sales taxes, of course, are not our preferred way to raise revenue because they put too much of the burden on people with low incomes who spend a larger share of their budget on taxable items. While we wish there was a better option than a sales tax, local governments have a limited set of fundraising tools. The need for this money is so great and the alternative sources of funds are so scarce that we recommend a yes vote even if we wish the more of the money came from those who can afford it.

Raise $4 million annually by increasing the tax paid when real estate is sold.

What is Proposition VV?

Prop VV would increase the real estate transfer tax in San Leandro from 0.6% to 1.1% for all properties. This increase is expected to raise $4 million annually for the city. The tax proceeds will be used to help fill a $9 million revenue shortfall caused by the pandemic. If passed, the new transfer tax would be similar to the rate in neighboring Oakland for properties worth $300,000 or less.

Position: Yes. We are generally strong supporters of transfer tax increases. They are a good way to reclaim some of the value from the record real estate appreciation in the Bay Area. While we generally prefer a progressive tax design where the tax rate increases with the property tax, the 0.5% increase from Prop VV is modest compared to the median home value of $700,000 in San Leandro. The budget woes caused by the pandemic have forced many cities to find new sources of revenue and we think this is a reasonable way for San Leandro to help fill its gap.