Catherine Bracy’s year in books 2024

Venture capital made headlines last year as its leaders verbally and financially declared allegiances during the 2024 presidential election. I wasn’t surprised. Venture capitalists have been quietly shaping the economy for years now, impacting the incentive structures in every industry and every part of people’s lives—like their housing.

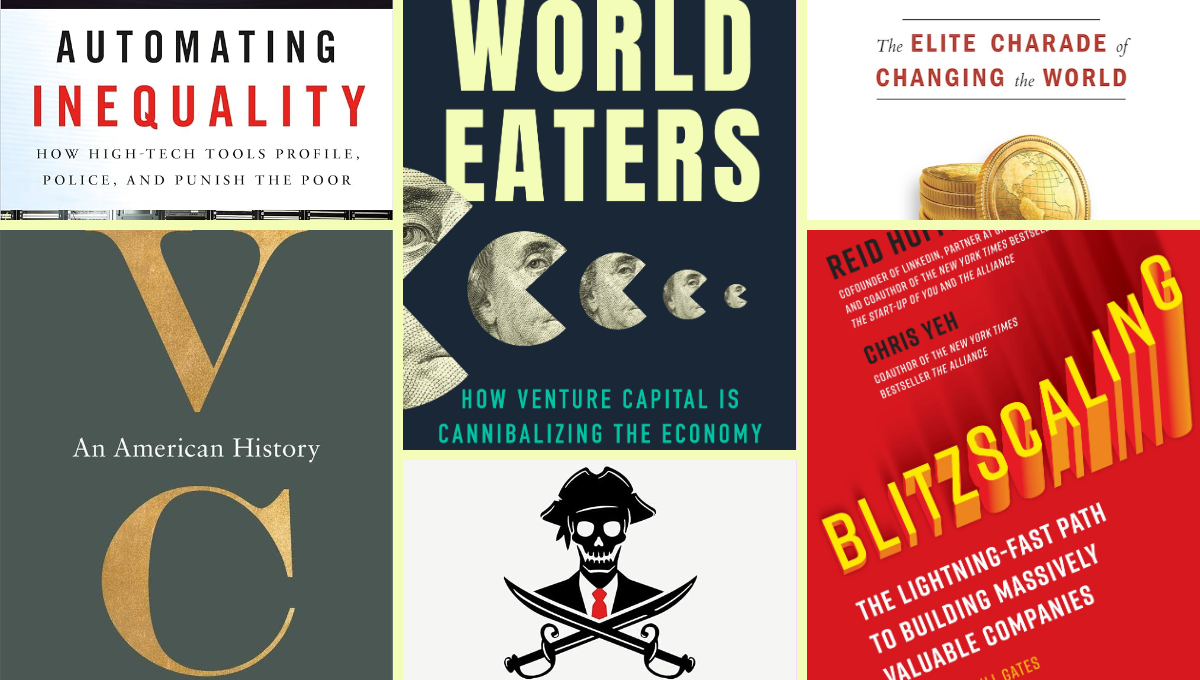

For the past three years, I’ve been writing a book on the topic, diving deep into the world of venture capital. I believe understanding and reforming it is key to creating a world where the tech industry is responsible for building widespread prosperity and is held accountable for the economic harm it creates in our communities. The product of that work, World Eaters: How Venture Capital is Cannibalizing the Economy, is out on March 4.

To shape the ideas that ultimately make up World Eaters, I relied not only on dozens of conversations with investors, entrepreneurs, and other stakeholders but on the research and writing of others. These are the books that inspired and informed me and ultimately helped me articulate what can be done to shape VC so that it fuels a tech sector whose gains benefit all of us.

VC: An American History

If you want to understand something as it is today, the key is to start with its origins. VC: An American History explores how venture financing grew out of the whaling industry to become the epicenter for high-tech development that it is today. The engine behind it all? The American spirit—adventure, risk-taking, and, of course, an unbridled quest for wealth through innovation. I came back to Nicholas’ work on an almost daily basis through my writing process. If you’re looking for a one-stop shop to understand the history and culture of VC, this is it.

Plunder: Private Equity’s Plan to Pillage America

Plunder deals in the current state of private equity—venture capital’s close sibling in the private capital family. Plunder helped me understand the broader context in which venture capital sits, the role it plays in the finance ecosystem, and how, ultimately, private capital as a whole has grown recklessly over the last decades. Author Brendan Ballou connects the rise of private equity to raising prices, reducing quality, cutting jobs, and shifting resources from productive to unproductive parts of the economy. It’s a bracing read for anyone who wants to understand an increasingly influential corner of our financial system.

Blitzscaling: The Lightning-Fast Path to Building Massively Valuable Companies

There is no shortage of content from venture capitalists extolling the virtues of their work and promoting their own genius. So it’s saying a lot to say that Blitzscaling is probably the single most important thing one can read to understand the VC mindset. From calling workers “growth limiters” to extolling the virtues of intentional thoughtlessness, when you read Blitzscaling, the seemingly bizarre behavior of some of the tech industry’s biggest darlings begins to make sense.

Automating Inequality: How High-Tech Tools Profile, Police, and Punish the Poor

But sometimes, what you break when you Blitzscale is people’s access to healthcare, affordable housing, quality jobs, and financial services. Biased algorithms are thrust onto the market and integrated into government services in the name of streamlining without the proper assessments and standards to anticipate and prevent harm. Automating Inequality delves into the consequences of this with heartbreaking personal stories from families across the country. It’s influenced a lot of our thinking and work at TechEquity—structural change that’s ultimately grounded in the stories of everyday people.

Winners Take All: The Elite Charade of Changing the World

These inequities can’t be solved by further “investment” alone, as Winners Take All reveals. In this book, Giridharadas shows how the global elite’s—many of whom are involved in venture capital—efforts to “change the world” preserve the status quo and obscure their role in causing the problems they later seek to solve. This book, though, is not just doom and gloom. It also contains a call to take on the grueling democratic work of institutional change that could truly change the world. At the end of the day, this is what TechEquity and World Eaters are all about.

World Eaters: How Venture Capital is Cannibalizing the Economy

Coming out on March 5th, World Eaters is the culmination of years of research and experience in tech’s impact on the economy. Since this is my book, I’ll quote Publisher’s Weekly: “Community organizer Bracy debuts with a bracing takedown of the venture capital financing model…it’s a convincing call for change.”

Pre-order World Eaters today and sign up for our newsletter to stay up-to-date with our new capital markets work.